Let's get one thing straight right off the bat – silver hasn't actually gained 90% in 2025. I know, I know, that headline probably caught your attention, but here's the honest truth: silver's up around 52-56% year-to-date as of early November 2025. That's still a pretty incredible run, don't you think?

As someone who's been in the precious metals business for over 15 years, I've seen my fair share of market rallies and crashes. And let me tell you, the current silver situation has everyone talking. But before you panic about missing your chance or worry about an imminent crash, let's dive into what's really happening with silver prices and whether now might be the right time for you to sell.

What's Really Driving Silver Prices Right Now?

You've probably heard all sorts of theories about why silver's been on this tear. Some folks are calling it a bubble, others are predicting it'll hit $100 an ounce. But here's what's actually moving the needle, based on what we're seeing in the market:

The Supply Crunch Is Real

Silver's been running a supply deficit since 2021, and it's not getting better anytime soon. Here's the thing most people don't realize – about 70% of silver comes as a byproduct from mining other metals like copper, lead, and zinc. When those operations slow down, silver supply gets squeezed hard.

Industrial Demand Is Through the Roof

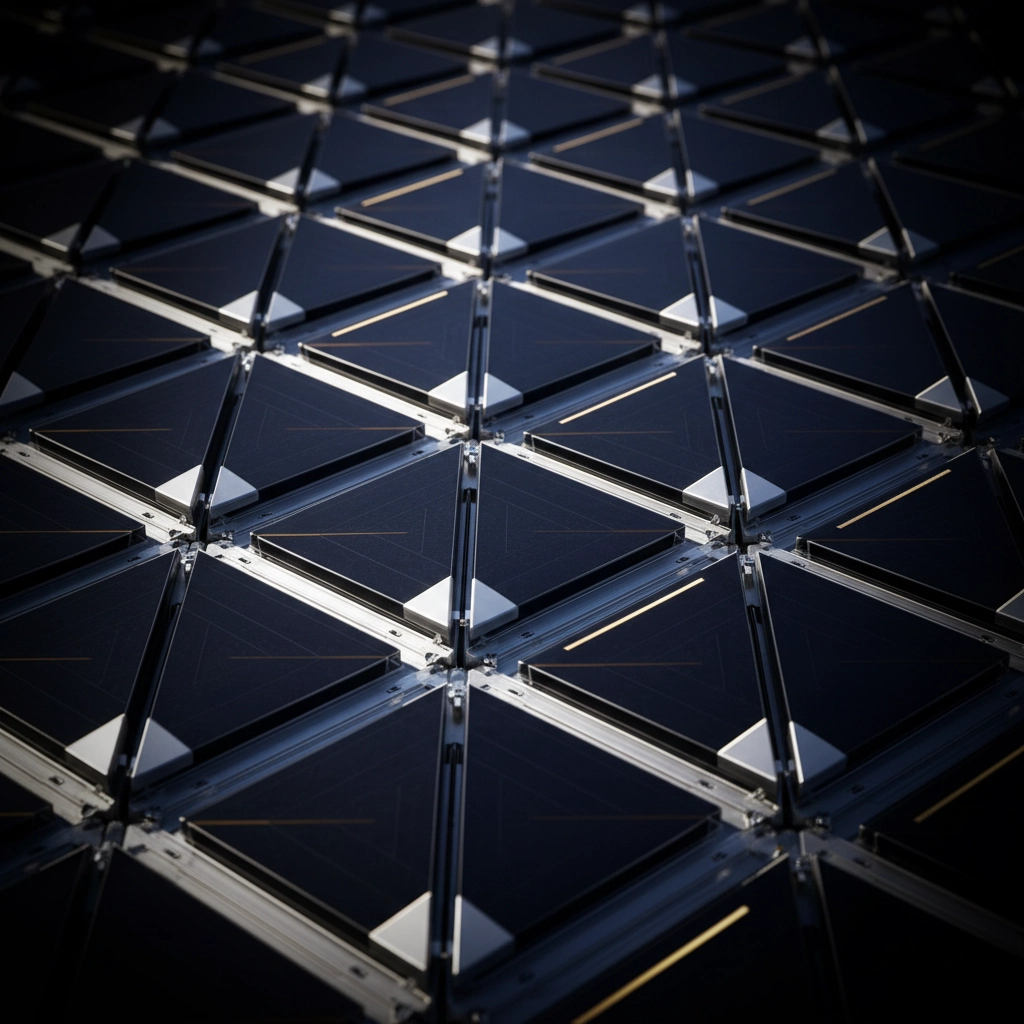

Remember when everyone was talking about going green? Well, it turns out silver is absolutely critical for that transition. Solar panels are gobbling up silver like there's no tomorrow, and the newer photovoltaic technologies need even more silver per unit than the older ones. Electric vehicles, 5G infrastructure, medical devices – they all need silver.

This isn't speculative money driving prices; it's real, industrial demand that's not going away anytime soon.

Is Silver Actually Overvalued Right Now?

Here's where it gets interesting. At around $48.74 per ounce (as of November 7th), you might think silver's gotten ahead of itself. But when you look at the gold-to-silver ratio – currently sitting around 90:1 – silver actually looks undervalued compared to gold.

Historically, this ratio averages between 60-75. When it gets as stretched as it is now, we often see silver outperform gold in the following months. That said, past performance doesn't guarantee future results, and there are no crystal balls in this business.

Should You Be Worried About a Crash?

The "crash" narrative is everywhere these days, isn't it? Every time precious metals have a good run, someone starts predicting doom and gloom. But let's look at the facts:

- The fundamental drivers (supply deficits, industrial demand) haven't changed

- Central banks are still buying precious metals

- Inflation concerns persist globally

- The green energy transition is accelerating, not slowing down

That doesn't mean prices can't pull back – they absolutely can and probably will at some point. Markets rarely move in straight lines. But a "crash" implies a fundamental breakdown in demand or a massive supply increase, neither of which seems likely in the near term.

The Real Question: What Should You Do With Your Silver?

Here's where my 15+ years in this business comes in handy. I've helped thousands of people navigate these exact situations, and here's what I've learned:

Consider Your Personal Situation First

Are you holding silver as an investment, or did you inherit some pieces you're not sure about? Do you need the cash for something important, or are you just wondering if you should take profits? Your personal financial situation matters more than any market forecast.

Think About Partial Sales

You don't have to sell everything at once. If you've got a decent amount of silver, consider selling a portion now and keeping the rest. This way, you lock in some gains while still participating if prices continue higher.

Don't Try to Time the Perfect Top

I can't tell you how many people I've seen wait for "just a little more" and end up missing great selling opportunities. If you're happy with your gains and have a use for the money, that might be reason enough to sell.

What Makes This Market Different

After being in this business since the early 2000s, I can tell you this silver rally feels different from previous ones. It's not driven by speculation or fear alone – there's genuine industrial demand supporting prices.

The solar industry alone is projected to need 15% more silver in 2025 than it did in 2024. Electric vehicle production keeps ramping up. And unlike previous rallies that were driven mostly by investment demand, this one has real, physical consumption behind it.

Signs to Watch For

If you're thinking about selling, here are some things to keep an eye on:

- If prices start moving up too fast (like 10%+ in a week), that might signal speculative excess

- Watch the news for any changes in solar or EV policy that could affect industrial demand

- Keep an eye on mining company announcements about new supply coming online

- Monitor the gold-to-silver ratio – if it starts narrowing quickly, silver might be getting ahead of itself

The Bottom Line on Timing

Here's the honest truth: nobody knows exactly when the best time to sell is. Not me, not the analysts on TV, not the guys posting predictions on social media. But what I do know from 15+ years of experience is this – if you're thinking about selling, you probably have good reasons.

Maybe you've got some silver jewelry sitting in a drawer that you never wear. Maybe you inherited coins that don't really fit your investment strategy. Or maybe you bought silver at $20 an ounce and you're pretty happy with a 140% gain.

Making the Decision That's Right for You

At the end of the day, the decision to sell should be based on your personal financial goals, not market predictions. If you need the money for something important, or if you're simply ready to take some profits off the table, current prices offer a good opportunity to do that.

And here's something else to consider – the transaction costs of holding physical silver (storage, insurance, etc.) might make it worth considering a sale even if you think prices could go a bit higher.

What We're Seeing in Our Business

From our perspective, we're seeing more people coming in to sell silver than we have in years. Some are taking profits on investments, others are cleaning out inherited collections, and quite a few are just curious about what their silver is worth in today's market.

The common thread? Most people are pretty happy with current prices. At $48+ per ounce, you're getting a lot more for your silver than you would have just two years ago.

Ready to Find Out What Your Silver Is Worth?

If you're sitting there wondering what your silver might be worth in today's market, why not find out? Whether you've got coins, bars, jewelry, or flatware, getting a professional evaluation costs you nothing and gives you the information you need to make an informed decision.

The silver market in 2025 has been exciting, that's for sure. Whether we're at a temporary peak or just getting started, having accurate information about your options puts you in the driver's seat. And in my experience, that's exactly where you want to be when making financial decisions.

Remember, there's no rush to decide. But there's also no reason to wonder "what if" when getting answers is easier than you might think. After 15+ years in this business, I can tell you that knowledge is always better than uncertainty – especially when it comes to your money.